In our 2021-year end commentary we wrote about how we expected more volatility in the equity market and a difficult year ahead for bonds as fiscal stimulus declines and monetary policy begins to tighten. However, we did not expect a stock market correction to begin days after writing and one of the biggest global fixed income sell-offs in history. Nor could we predict the devastating war in Ukraine and the effect it would have on commodity prices, and thus inflation. In March, the S&P 500 entered correction territory down more than 10% and the NASDAQ 100 entered a bear market of down more than 20% before recovering half their losses. The real damage can be seen not at the index level, but at the individual stock level where half of the stocks in the S&P 500 saw draw downs of 20+% and the average stock draw down in the last six months was 21.6%. Companies that benefited most during COVID saw declines of 50% – 80% from their highs. The sell-off in the bond market has been arguably worse than that in the equity market, with the Bloomberg Aggregate bond index down 5.93% and the Bloomberg Global Aggregate bond index down 6.16% in the first quarter.

The US economy grew 5.7% in 2021 and economic output is now back to where it would have been if COVID had not happened. Economic growth slowed in the first quarter, largely due to disruptions caused by the surge in the Omicron variant but has reaccelerated and the economy remains strong. The labor market is extremely tight with 1.89 job openings for every person unemployed. Nonfarm payrolls increased 431,000 in March and the unemployment rate fell to 3.6%. Average hourly earnings rose .4% and are up 5.6% versus a year ago. The strong labor market is supportive of the economy; however, sustained wage growth will continue to put upward pressure on inflation.

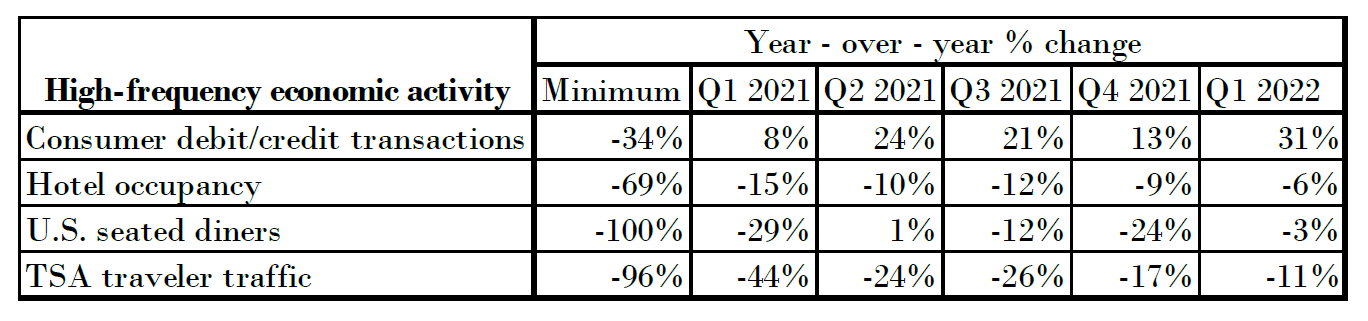

Throughout the COVID-19 pandemic, we have been watching some of the high frequency data to better understand the fast-moving nature of the economy. The below table illustrates some of this data:

This data is nearing levels last seen before the pandemic and we expect further improvement. Business travel is still not back to where it was, which skews the TSA traveler traffic to the downside as consumer travel is now only down 8%. While last year we focused on the enormous amount of stimulus in the system, this year we are focusing more on the risks.

The three risks we see are the war in Ukraine and the sanctions on Russia, The Federal Reserve (FED) tightening monetary policy, and inflation. The war in Ukraine and the sanctions on Russia will, at a minimum, slow the global economy. Since World War II, geopolitics have rarely disrupted the global economy, with the exception being the 1973 OPEC oil embargo. Yet global energy, commodity and agricultural markets have been roiled by the recent conflict. The Euro area, which is highly dependent on Russian oil and natural gas, will likely see economic growth cut in half this year due to the war and sanctions. The US is more energy independent and thus the war is estimated to decrease GDP by only half of 1% of what it would have been otherwise. These estimates are based on current conditions, but further sanctions could have an unpredictable effect. Russia accounts for 11% of global oil production and 17% of global natural gas production. Western Europe receives 40% of its natural gas from Russia, while Russia only accounts for 8% of total US energy imports. The efforts to reduce purchases of Russian energy has raised prices and hurt the European economy more than the US.

Inflation remains high and is now the FED’s biggest concern. Aside from the impact of the war on commodity, energy, and agricultural prices, we are beginning to see improvements in other areas. Pandemic related supply chain disruptions seem to be easing. Supply chains and global trade will have to be restructured after COVID and the war in Ukraine, so that necessary goods are produced by the US and its allies, rather than the lowest cost producer. This will make some goods more expensive in the long run, but for now, the easing of supply chain disruptions should help alleviate some of the upward pressure on inflation. We are also seeing US consumers switch their purchases away from goods and back to services as the economy opens back up. The ISM Services Index rose to 58.3 (anything above 50 is expansionary) in March while the ISM Manufacturing Index declined to 57.1. The US has typically been a service driven economy, but when COVID hit that spending shifted to goods causing the demand for goods to outweigh the supply and thus prices to increase. That excess demand was also increased by an incredible amount of fiscal stimulus. Compound that excess demand with supply shortages and the result was the highest inflation we’ve seen since the 1980s. The shifting of consumer purchases back to services and the easing of supply chains suggests inflation may peak by summer. Energy and agriculture remain unknowns and will depend on the direction and duration of the war in Ukraine. Housing tends to be sticky but aggressive tightening by the FED should put some downward pressure on prices as well. Wage gains may be moderating as the labor participation rate begins to trend upwards, which should also ease some of the inflationary pressures.

The FED is most likely the largest risk to the market and the economy as it tries to tame inflation by aggressively raising rates and reducing its balance sheet while not sending the US into a recession. If they get it right, inflation will start to recede, and we could have many years of growth ahead. The FED raised the Fed Funds Rate 25 basis points or .25% in March and have become even more hawkish (or aggressive) than they were at the December meeting. A fifty-basis point hike, or .50% increase at the May meeting is now likely, while the size of the June hike we think will be 25 basis points but have little confidence in this number. The FED will also likely announce a rapid runoff of the balance sheet at the May meeting of roughly $100 Billion a month. This should put upward pressure on interest rates across the curve. The FED has more control of the short end of the yield curve by setting the Fed Funds Rate. Therefore, if they raise short term rates and longer-term rates do not rise as well, the yield curve can invert. We have seen some temporary inversions between the two-year and ten-year treasuries recently and are likely to see more as the FED raises short term rates. This has market participants talking because a yield curve inversion always precedes a recession. A recession, however, does not always succeed a yield curve inversion and the time between an inversion and subsequent recession can very dramatically.

Each of these issues present their own risks and may be able to be managed. However, these risks taken together may have unknown consequences. We do not think a recession is likely this year, but the risk of one next year has risen. The past two recessions, COVID and the Global Financial Crisis, were the worst since the Great Depression. The next recession doesn’t have to be as severe, rather it could be similar to the 1990 recession that was exacerbated by a commodity shock. While there are many similarities to 1990 – heightened geopolitical risk, a commodity shock, declining consumer confidence and slowing foreign growth – there are also some key differences. The Savings and Loan crisis of the 1980’s resulted in massive bank failures and a collapse in bank credit from 1989 – 1992. Additionally, the US currently has strong economic momentum with GDP growing above potential, strong consumer balance sheets, an extremely tight labor market, and accommodative fiscal spending. For these reasons, the future does not have to be a repeat of 1990. Nor do we think this commodity shock will be like that of the 1970’s. Goldman Sachs economists estimate that it would take sustained oil prices above $200 a barrel to produce an income shock similar in magnitude to those that precipitated the 1974 and 1979 recessions. The US is much more energy independent, and the economy is only 25 percent as reliant on energy as it was in the 70’s. Price increases for energy and agriculture over the last year represent about 1.9% of consumer spending, however, wage gains of 5.6% and excess COVID savings, has meant that this did not result in lower overall consumption.

In conclusion, the US economy is strong, but the markets are turbulent as they try to price in and brace for the unknown ahead. Interest rates should rise across the curve, possibly dramatically, and will be felt throughout the market and economy. While probability of a recession has increased, that does not mean it is likely, rather the confluence of the factors described above have increased the risk. Our hearts go out to those in Ukraine, and we hope for a quick and adequate resolution to this tragic war.

Take care and be well,

The Management Team

Michael, Michelle, Jolie and Nina

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Socha Financial Group, LLC (“SFG”), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Socha. Please remember to contact Socha, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Socha is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of the SFG’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your Socha account holdings correspond directly to any comparative indices or categories. Please Also Note: (1) performance results do not reflect the impact of taxes; (2) comparative benchmarks/indices may be more or less volatile than your Socha accounts; and, (3) a description of each comparative benchmark/index is available upon request.

Please Note: Limitations: Neither rankings and/or recognition by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any designation or certification, should be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results if Socha is engaged, or continues to be engaged, to provide investment advisory services. Rankings published by magazines, and others, generally base their selections exclusively on information prepared and/or submitted by the recognized adviser. Rankings are generally limited to participating advisers (see link as to participation data/criteria, to the extent applicable). Unless expressly indicated to the contrary, Socha did not pay a fee to be included on any such ranking. No ranking or recognition should be construed as a current or past endorsement of Socha by any of its clients. ANY QUESTIONS: SFG’s Chief Compliance Officer remains available to address any questions regarding rankings and/or recognitions, including the criteria used for any reflected ranking.